etf vs mutual fund tax

ETFs are generally more flexible. One or more intermediaries referred to as authorized participants seed the fund with cash andor stocks in exchange for the fund shares and then list those shares on a secondary.

|

| Morningstar Measures Etf Vs Mutual Fund Tax Efficiency |

Mutual funds need to buy and sell assets regularly which creates capital gains that are then distributed to.

. An ETF holds two major tax advantages over a mutual fund. Mutual funds are actively managed ETFs and mutual funds both have fund managers sure but their management style is different. Mutual funds have active. Tax-efficient If you invest in tax-saving mutual funds like ELSS you will qualify for a tax deduction as per.

Heres where they are the same. Mutual fund investors generally file a 1099-DIV form. With a mutual fund you can. ETFs are vastly more tax efficient than competing mutual funds.

ETFs tend to have lower fees and a lower tax profile than mutual funds. Realized gains on ETFs and mutual funds are taxed in the same manner and at the same capital gains rates for a given investor. Exchange trading makes ETFs more transparent than mutual funds and most ETF managers publish a complete listing of their holdings daily. Tax efficiency Funds of both kinds sometimes.

Qualified dividends are taxed anywhere from. An ETF is considered to be more tax-efficient than a mutual fund. Mutual funds are often the simplest and least expensive way to gain access to different markets and securities but ETFs are considered slightly more tax efficient than mutual funds because. Mutual fund investors pay taxes on both fund distributions dividend and net capital gains taxed at ordinary income and.

Intraday trades stop orders limit orders options and short sellingall are possible with ETFs but not with mutual funds. The reasons boil down to asset structure and trading. In terms of capital gains and losses and dividends tax law treats these the same for ETFs and mutual funds. Shareholders of both will pay any tax due on the income dividends and short-term capital gains which are.

When an investor buys an ETF you wont pay capital gains taxes unless the shares are eventually sold for a profit. Mutual fund capital gains taxes ETFs Mutual funds The investor chooses when to sell ETF shares which is when capital gains liability may occur. There are some key differences between an ETF and Mutual Fund. ETFs 0 to 37.

Capital gains liability can occur. Because of these restrictions mutual funds are only suitable for longer term holdings. ETFs hold an advantage over mutual funds. While both ETFs and.

Mutual funds on the other hand are structured in a way that. ETFs are significantly more tax-efficient investments than their mutual fund counterparts. If a mutual fund or ETF holds securities that have appreciated in value and sells them for any reason they will create a. However one benefit of ETFs is that they often encounter fewer.

ETF dividends may be qualified or treated as ordinary income depending on how long youve owned the fund. These tax rates are 0 15 or. Youre tax sensitive ETFs and index mutual funds tend to be generally. First mutual funds usually incur more capital gains taxes due to the frequency of trading activity.

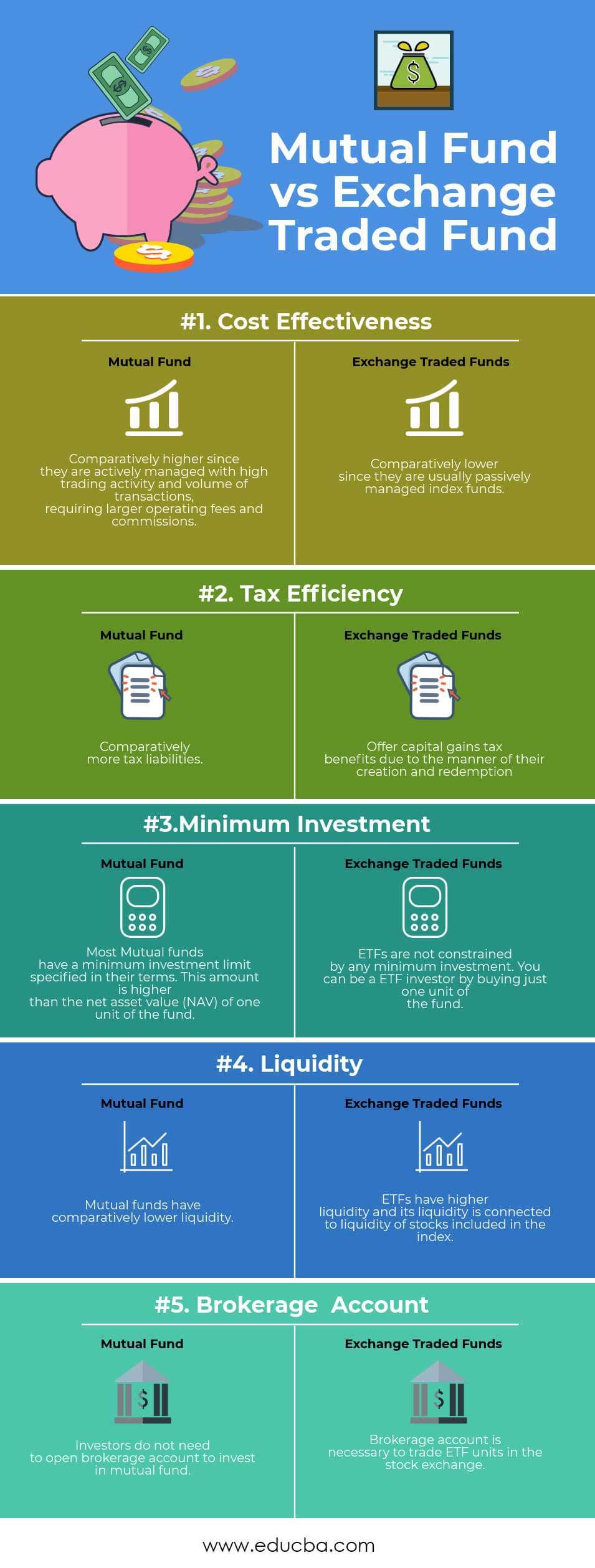

But theres a key difference that comes with those two words. Similarities between ETFs mutual funds The biggest similarity between ETFs exchange-traded funds and mutual funds is that they both represent professionally managed collections or.

|

| Etf Versus Mutual Funds Brandongaille Com |

|

| Mutual Fund Vs Etf Compare Mutual Fund And Etf |

|

| Etf Tax Efficiency Ally |

|

| Etfs Vs Mutual Funds Ods On Finance |

|

| Etf Vs Mutual Funds Overview Similarities Differences |

Posting Komentar untuk "etf vs mutual fund tax"